FERC, the US Federal energy regulator, has published its FY 2025 enforcement report (click here). The 87-page report addresses the activities of the three divisions within FERC Enforcement namely the Division of Investigations (DOI), the Division of Audits and Accounting (DAA), and Division of Analytics and Surveillance (DAS).

The report covers five distinct areas borne from FERC’s FY 2025 strategic priorities. These comprise fraud and market manipulation, serious violations of the Reliability Standards, anticompetitive conduct, threats to the US’s energy infrastructure and conduct that threatens the transparency of regulated markets. FERC’s financial year runs until 30 September each year. FERC has had a somewhat tumultuous year with the change in the US administration and the multiple changes in leadership both in the departures and arrivals of new Commissioners and the appointment of multiple FERC Chairs. Regardless, the Commission has been notably active at an operational level with many new enforcement actions and investigations launched.

For the summary below, we focus primarily on the DOI’s enforcement actions and the surveillance topics under DAS. For the DOI, the report addresses FY 2025 settlements, self-reporting, investigations, and market monitor referrals. Over the year, FERC approved 13 settlements totalling approximately USD 22.84 million in civil penalties and USD 18.73 million in disgorgement, with most violations involving tariff breaches alongside notable (although reduced) market manipulation and market behaviour cases. The DOI received 153 self-reports, closing 163 overall (some of which were carried over from previous fiscal years). The report points to the significant mitigation value of timely self-reporting.

The DOI also opened 24 new investigations, many involving potential manipulation, tariff violations, or FERC’s Duty of Candor rule, and closed 17 with no further action due to insufficient evidence or immateriality. Market Monitor referrals remained a key pipeline for enforcement, generating 22 new referrals;

The DAS reported high levels of data-driven screening and analytic work across natural gas and electricity markets. In natural gas, DAS documented 1,780 surveillance reviews, opened 24 new inquiries, and referred one case to DOI while closing most others. In electricity markets, DAS advanced its transition from static screens to dynamic dashboards capable of identifying increasingly complex forms of potential manipulation across financial and physical products.

These modernised tools supported 1,920 surveillance reviews, resulting in 36 electric inquiries, of which 10 were referred for investigation and 21 of which were closed. DAS’s enhanced analytics spanning FTR-related behaviour, uneconomic virtual trading, anomalous offer patterns, and cross-market portfolio activity go some way in demonstrating FERC’s continued investment in improving its surveillance capabilities.

Below a summary is provided of some of the key statistics from an enforcement perspective under the DOI and from a surveillance perspective under the DAS.

1. Division of Investigations (DOI)

For those interested in understanding more about how FERC approaches enforcement cases from investigation through to ultimate settlement, you are advised to read the explanation provided on pages seven and eight.

Settlements:

- Over the year FERC approved 13 settlement agreements to resolve pending enforcement matters, including 11 investigations, one administrative proceeding, and one Commission Penalty Order;

- The settlements totalled approximately USD $22.84 million in civil penalties and disgorgement of USD $18.73 million;

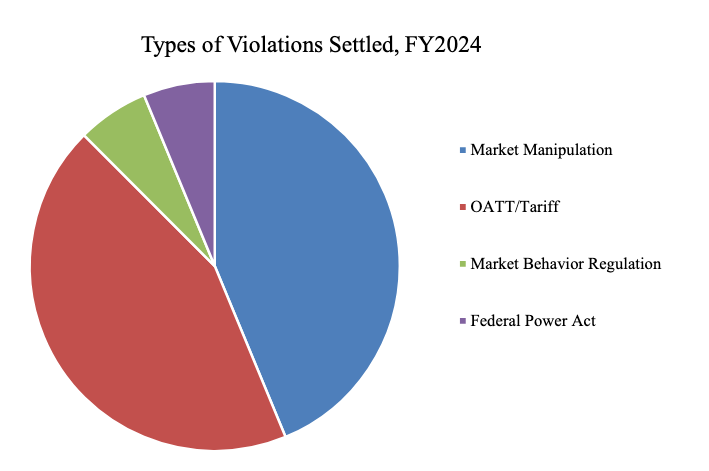

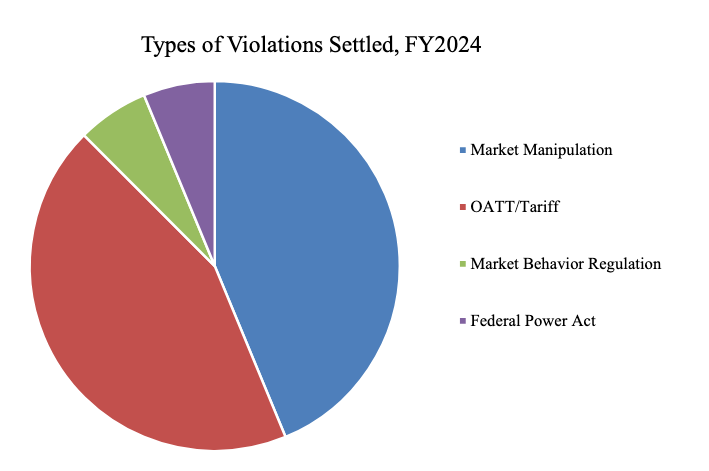

- The breakdown of the settled violations comprise a significant number of Tariff violations, with Market Behaviour and Market Manipulation both combining in significant numbers per the graphic below (see page 20 of the report):

Source: FERC

- Compared to FY 2024, there has been a marked reduction in Market Manipulation and Market Behaviour cases on a year-to-year basis per the graphic below (see page 21 of the report):

Source: FERC

- Below we provide a list of the 11 settled cases and the corresponding links to the relevant Order:

- Public Service Electric and Gas Company, Docket No. IN21-5-000 (Order)

- Sonoran West Solar Holdings, LLC and Sonoran West Solar Holdings 2, LLC, Docket No. IN24-13-000 (Order)

- Montpelier Generating Station, LLC and Rockland Capital, LP, Docket No. IN24-15-000 (Order)

- EWP Renewable Corporation, Docket No. IN24-12-000 (Order)

- Voltus, Inc. and Gregg Dixon, Docket No. IN21-10-000 (Order)

- Stronghold Digital Mining Inc. and Scrubgrass Reclamation Company, L.P., Docket No. IN24-14-000 (Order)

- GenOn Holdings, Inc., Docket No. IN25-3-000 (Order)

- Green Plains, Inc., Docket No. IN25-2-000 (Order)

- Enel North America, Inc., Chisholm View Wind Project, LLC, Docket No. IN25-5-000 (Order)

- Skye MS, LLC, Docket No. IN25-9-000 (Order)

- Cordova Energy Company LLC, Docket No. IN25-8-000 (Order)

- For the shorter summaries of the above cases, refer to pages 23 to 27 of the report;

- The report notes (on page 10) that aspects of FERC’s processes have been challenged in light of the Supreme Court’s decision in SEC v. Jarkesy which found that some cases are entitled to a jury trial rather than determinations being made by a Federal regulatory authority (including FERC).

- The report lists seven other significant matters either subject to district court action or to administrative proceedings with FERC – for more information refer to pages 10 to 17 of the report.

Self-reporting:

- The topic of self-reporting is addressed from page 27 of the report. FERC received 153 new self-reports in FY2025 from a variety of market participants, including public utilities, natural gas companies, generators, and ISOs/RTOs;

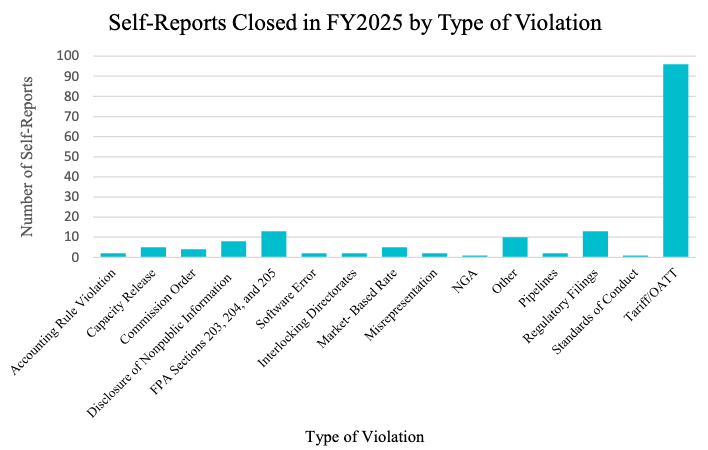

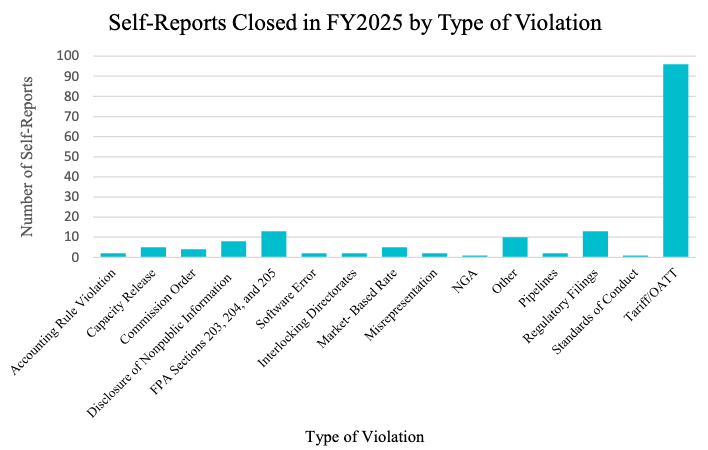

- Over 50% (79) were from ISOs/RTOs and involved relatively minor violations of tariff provisions per the FY 2025 summary below (see the image on the top of page 28):

Source: FERC

- FERC staff closed 163 self-reports over the year, 31 of which were carried over from previous fiscal years;

- FERC reminds firms about the importance of self-reporting where significant mitigation credit for self-reports is possible;

- The report contains several examples of self-reports which were closed without further action (presumably a subtle hint as to the types of things FERC is not particularly interested in receiving!) – see pages 30 – 35 for these summaries.

Investigations:

- In FY 2025 FERC opened 24 new investigations compared to 30 in FY 2024 and 19 in FY2023;

- These arose from several sources including referrals from ISO/RTO Market Monitors and other FERC divisions;

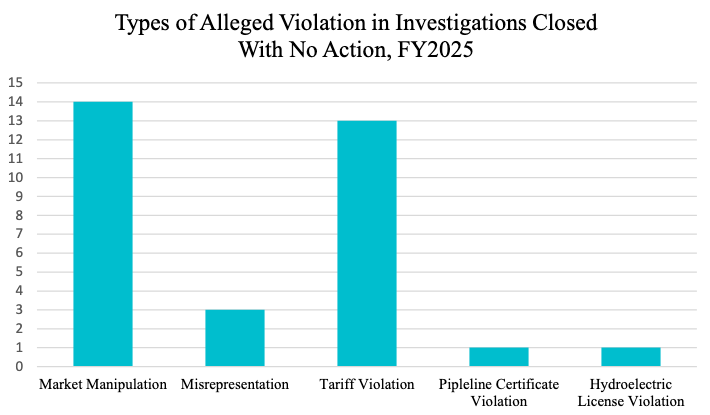

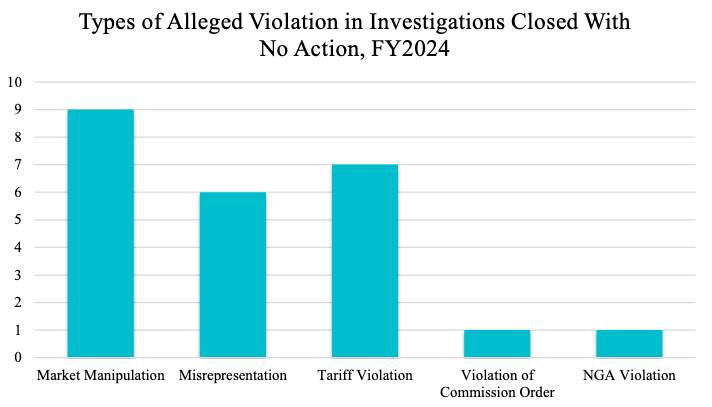

- FERC closed 17 investigations without further action in FY2025 (compared to 10 in FY 2024);

- Of the 24 new investigations at least 11 involved potential market manipulation, 17 involved potential tariff violations, and six involved potential misrepresentations prohibited by FERC’s Duty of Candor Rule;

- In the 17 investigations the DOI closed with no action FERC found that there was either no violation, insufficient evidence to establish that a violation had occurred, or that a violation existed but should not be subject to sanctions;

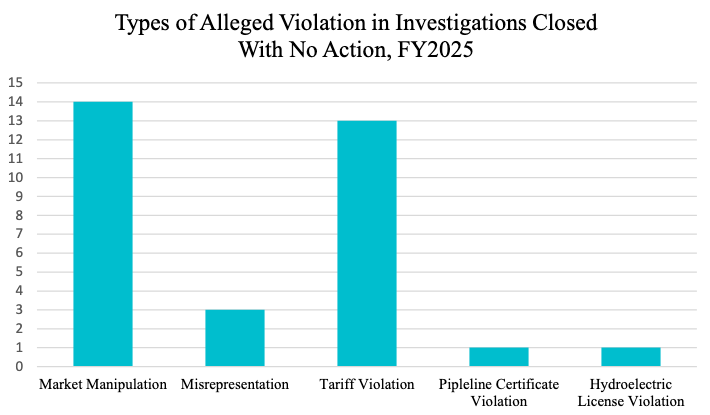

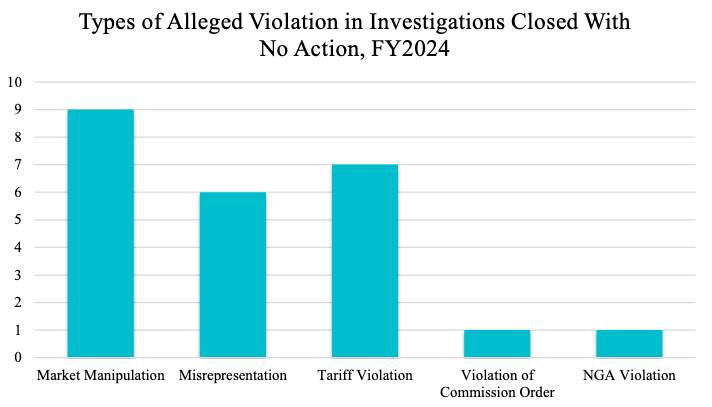

- The charts below show the nature of the conduct at issue for those investigations that were closed without further action over FY 2024 and 2025 (see page 39 and 40 of the report):

Source: FERC

Source: FERC

- The report contains several summaries of the types of investigations closed without any action on pages 41 to 45 for those interested.

Market Monitor Referrals:

- Under FERC rules, ISO and RTO Market Monitors are required to make a non-public referral to the Commission in all instances where the Market Monitor has reason to believe that a Market Violation has occurred;

- In FY 2025 FERC received 22 new Market Monitor referrals of which at least 11 involved potential market manipulation, and at least 19 involved potential tariff violations;

- At least eight involved potential misrepresentations prohibited by FERC’s Duty of Candor Rule and 16 became the sources for investigations opened in FY 2025 (i.e. two thirds of all new cases opened by FERC over the year!).

2. Division of Analytics and Surveillance (DAS)

DAS develops surveillance tools, conducts surveillance, and analyses transactional and market data to detect potential manipulation, anticompetitive behaviour, and other anomalous activities in the market. DAS focuses on natural gas surveillance, electricity market surveillance and analytics for reviewing market participant behaviour.

Natural gas:

- In FY 2025, FERC ran automated screens and reviewed dashboards to examine market participant activity in the daily and monthly markets;

- DAS staff reviewed and dismissed most screen trips (i.e. alerts) as consistent with concurrent conditions but documented 1,780 surveillance reviews that ranged in severity from low to high concern;

- In FY 2025, DAS closed the two pending inquiries from FY 2024 with no referral and opened 24 new natural gas surveillance inquiries of which 20 were closed with one being referred to the DOI for investigation;

- Four of the inquiries initiated in FY 2025 remain open with DAS staff continuing its analytic work.

Electricity:

- During FY 2025, DAS began transitioning from static screens with defined trips to developing dynamic dashboards that allow greater flexibility in the detection of potentially manipulative behaviour;

- DAS also ran monthly and weekly screens to identify patterns by monitoring the interactions between bids and cleared physical and financially-settled electricity products;

- These enhanced tools identify financial transmission rights (FTRs) and swap-futures that settle against nodes that are affected by transmission constraints where market participants also trade virtuals, generate electricity, purchase electricity, or move power between Balancing Authorities;

- In FY2025 DAS undertook an effort to modernize and streamline its surveillance process for electricity markets using cutting-edge techniques;

- DAS began to utilize more advanced dynamic dashboards that have user-defined parameters rather than static screen trip metrics to enhance its ability to detect potentially manipulative behaviour;

- DAS transitioned all of its legacy code to newer and more agile code bases and continued to refine its processes for screening to detect:

- Uneconomic virtual transactions by node, zone, and constraint;

- Potential day-ahead and real-time market congestion manipulation that would benefit financial transmission rights in the ISO/RTO markets, synthetic real-time financial transmission rights, swap-futures positions for physical load, and generation portfolios;

- Anomalies in physical offer patterns, particularly in non-price based parameters;

- Abnormal out-of-market payments;

- Irregularities in capacity market sell offers;

- Loss making physical fixed-price offer strategies in bilateral electricity markets; and

- Anomalous behaviour by energy storage and demand response resources.

- DAS also continued to develop its tools to view patterns of behaviour on a portfolio basis, across Balancing Authority borders and jurisdictional commodities.

- During FY 2025, DAS ran and reviewed 160 electric surveillance screens and dashboards; monthly, hourly, and intra-hour sub-screens; and reports for over 44,000 hub and pricing nodes within the six ISOs/RTOs;

- DAS also screened non-ISO/RTO markets and cross-ISO/RTO portfolio trades for potential manipulation;

- DAS conducted 1,920 individual surveillance reviews in FY2025 and from those it identified 36 instances of market behaviour that required further analysis through a surveillance inquiry;

- Of the 36 electric inquiries, 10 were referred to the DOI for investigation, 21 were closed with no referral, and five remain open with DAS continuing its analytic work.

.png)